To calculate capital gains, you’ll need your basis, or the cost of the asset when you paid for it. Gains aren’t a guaranteed possibility, however. How Are Capital Gains Calculated and Reported?

Short-Term Capital Gains Tax Rates for 2022 Rate Short-Term Capital Gains Tax Rates for 2023 Rateįor comparison, the 2022 numbers are in the table below. In 2023, capital gains tax rates for short-term capital gains depend on income tax brackets, which also factor in filing status. For comparison, here are the 2022 numbers: Long-Term Capital Gains Tax Rates for 2022 RateĪnd just like with the tax rates in 2022, capital gains tax rates for short-term capital gains in 2023 also depend on income tax brackets that factor in filing status. Long-Term Capital Gains Tax Rates for 2023 Rate

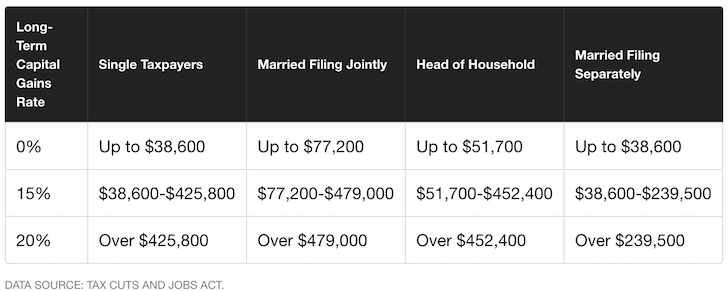

Short-term gains are taxed as ordinary income. Short-term capital gains come from assets held for under a year.īased on filing status and taxable income, long-term capital gains are taxed at 0%, 15% and 20%. Long-term capital gains come from assets held for over a year. When an investor realizes a capital gain, any proceeds will be considered taxable income.Ĭapital gains vary depending on how long an investor had owned the asset before selling it. Making a profit means the investor now has income, of course, so this must be factored in when filing taxes. Capital gains refer to the money that an investor makes as the profit from selling one or more of their investments or assets.

0 kommentar(er)

0 kommentar(er)